Exploratory Data Analysis of Moscow Real Estate 2018-2021

Exploratory Data Analysis (EDA) serves as a foundational step in analyzing and understanding the intricacies of Russia's real estate market spanning the years 2018 to 2021. This EDA aims to provide valuable insights into market trends, patterns, and opportunities within the Russian real estate sector during the specified period.

GOAL

The objective of the exploratory data analysis is to identify the primary factors and variables that influence apartment prices in the Moscow region using data from property listings for the years 2018-2021. The dataset consists of lists of unique objects of popular portals for the sale of real estate in Russia. The dataset contains 540000 real estate objects in Russia.

KEY FEATURES

- Data Collection and Cleaning: Gather and compile a comprehensive dataset of property listings, including relevant details such as apartment size, location, amenities, condition, and selling prices. Conduct thorough data cleaning to address missing values, outliers, and inconsistencies to ensure the accuracy and reliability of the dataset.

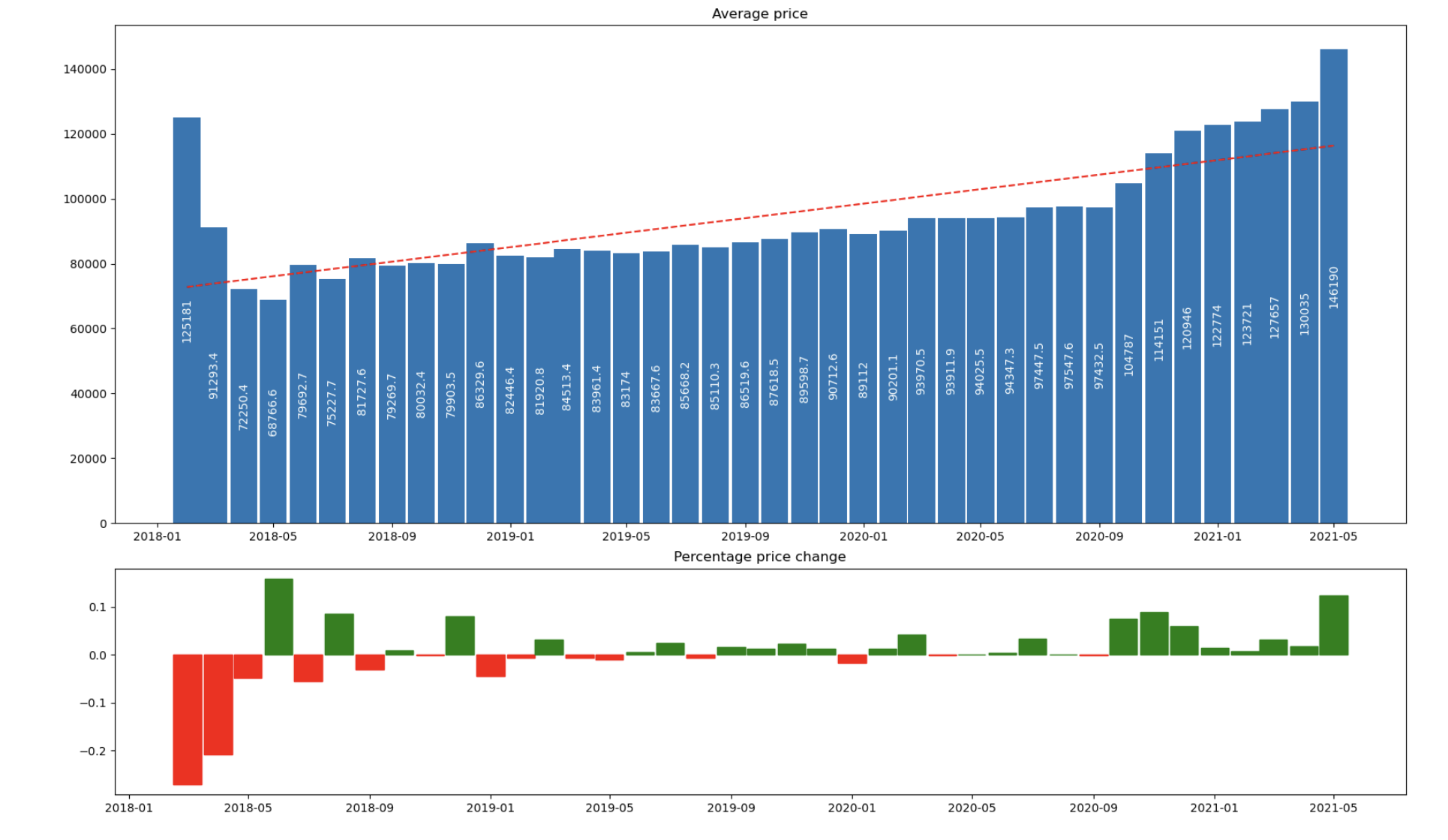

- Descriptive Statistics: Calculate and analyze summary statistics to understand the distribution, central tendencies, and variability of apartment prices and key variables across different regions, property types, and time periods within the Moscow region.

- Data Visualization: Visualize the data through various graphical representations, including histograms, box plots, scatter plots, and heatmaps, to explore the relationships, trends, and patterns between apartment prices and influencing factors such as location, size, amenities, and market demand.

- Correlation Analysis:Evaluate the relationships between apartment prices and potential influencing factors by calculating correlation coefficients and performing regression analysis. Identify and quantify the impact of each variable on apartment prices to understand the underlying dynamics and market trends.

- Insight Generation and Interpretation:Derive actionable insights, patterns, and trends from the EDA results to understand the main factors influencing apartment prices in the Moscow region. Provide a comprehensive interpretation of the findings to guide stakeholders in making informed decisions and strategies related to the real estate market.

RESULT

The EDA provides strategic insights into the Russian real estate market's performance, trends, and dynamics between 2018 and 2021, enabling investors and developers to identify growth opportunities, assess risks, and formulate informed investment strategies. The EDA serves as a robust decision-support tool, providing stakeholders with actionable insights, data-driven recommendations, and evidence-based rationales to guide investment decisions, market positioning, and strategic planning within the Russian real estate market. In conclusion, the Exploratory Data Analysis for Moscow Real Estate Data (2018-2021) as a portfolio case offers a comprehensive and systematic approach to understanding and navigating the complexities of the Russian real estate market. By leveraging data-driven insights and analytical techniques, stakeholders can make informed decisions, capitalize on market opportunities, and achieve sustainable growth and profitability in their real estate investments.